Current Residents

Future Residents

Medical Students

Faculty

Ultrasound

Fellowships

Research

LIFESTAR

Simulation Center

Hyperbaric Center

Image of the Month

Links

Contact Us

The University of Connecticut Integrated Residency in Emergency Medicine provides an exceptional training

opportunity for the Emergency Medicine resident. A dynamic faculty, strongly committed to teaching, is combined with health care institutions that have a long established record of excellence in all aspects of medical education. With systematic emphasis on both personal and professional growth, we expect our graduates to become capable leaders in their hospitals and communities and to fulfill on their commitment to clinical and personal excellence.

Our program’s integrated model utilizing a primary clinical site with four affiliate institutions is both a distinctive feature and a strength. Hartford Hospital is the regions Level 1 trauma center with an active aeromedical program and the state’s highest patient volume emergency department (approaching 100,000 a year). Hartford Hospital opened its newly constructed Emergency Department in December of 2001. This state of the art ED offers an excellent environment in which to foster the education of our residents.

John Dempsey Hospital (UCONN Health Center) provides exposure to a University Hospital ED with a completely undifferentiated patient population. Connecticut Children’s Medical Center, opened in April 1996, is the state’s only free standing children’s hospital, and has an annual censes of about 45,000 patients a year. Its emergency department is staffed by pediatric and emergency physicians with fellowship training in pediatric emergency medicine.

Additional distinguishing program characteristics include:

- A combined Department of Traumatology and Emergency Medicine (as a separate division)

- Active involvement with the Connecticut Poison Control Center and toxicology fellowship program

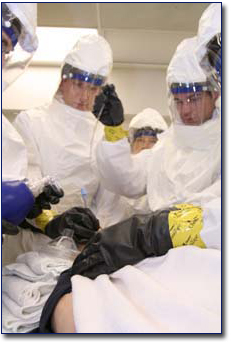

- Southern New England’s only aeromedical critical transport service

- The largest multi-chamber hyperbaric oxygen facility in New England

- Newly constructed 14,000 sq ft Center for Education, Simulation, and Innovation (our Simulation Center)

- Formal ultrasound training with a certified attending and a state of the art machine purchased by the department in February 2010

- Fellowships offered in Toxicology, Aeromedical / EMS, Pediatric Emergency Medicine and in Administration / Research

- Plenty of opportunities for resident teaching of medical students

- Strong on-site residency leadership at all participating institutions

- Generous clerical support, dedicated space and computer services for residents at each site

In summary, our program combines the assets of urban, community, and university practice settings under close academic sponsorship of the medical school. Together, our institutions assure broad clinical exposure and diverse resident experiences on all levels of patient care. We welcome you to review the information on this website to find out more about what we can offer you as a prospective residency applicant.